21++ Discounted cash flow excel download ideas

Home » Background » 21++ Discounted cash flow excel download ideasYour Discounted cash flow excel download images are ready in this website. Discounted cash flow excel download are a topic that is being searched for and liked by netizens now. You can Download the Discounted cash flow excel download files here. Get all royalty-free images.

If you’re looking for discounted cash flow excel download images information connected with to the discounted cash flow excel download topic, you have visit the ideal blog. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

Discounted Cash Flow Excel Download. Even with this version of the discounted cash flow spreadsheet, there are disadvantages to using the dcf model, but it is logical and reasonable. The discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Before moving on, i also created a free graham formula spreadsheet that may interest you. Guide to discounted cash flow valuation analysis.

Financial Projections & Forecasting Excel Models Templates From pinterest.com

Financial Projections & Forecasting Excel Models Templates From pinterest.com

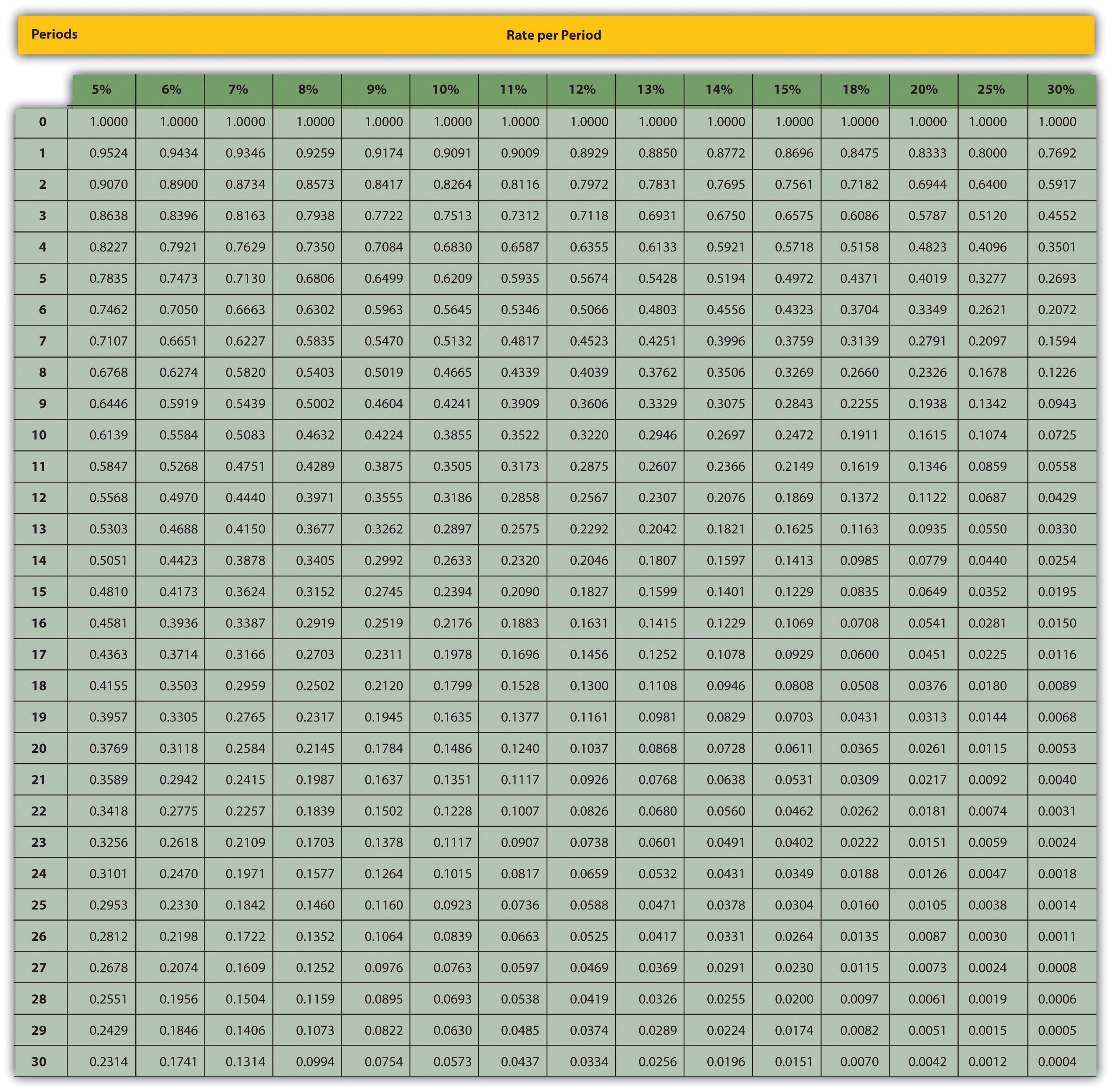

However, building a dcf can be tedious and complex — especially if you are building one from scratch — spreadsheets are reused for years. Dcf analysis is focused on the time value of money. The discount factor is a factor by which future cash flow is multiplied to discount it back to the present value. Before moving on, i also created a free graham formula spreadsheet that may interest you. The discount factor effect discount rate with increase in discount factor, compounding of the discount rate builds with time. The model is completely flexible, so that when you put in the inputs data the model calculates the p&l and does valuation automatically.

The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date.

The discounted cash flow (dcf) formula is equal to the sum of the cash flow valuation free valuation guides to learn the most important concepts at your own pace. Our discounted cash flow template will help you to determine your value of the investment and calculate how much it will be in the future. The template comes with various scenarios along with sensitivity analysis. Discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. The model is completely flexible, so that when you put in the inputs data the model calculates the p&l and does valuation automatically. This is a very useful cash flow excel template which can be used to calculate the inflow and outflow of cash for a company to calculate its net cash balance.

Source: pinterest.com

Source: pinterest.com

Allows you to start planning with no fuss and maximum of help. Basically, a discounted cash flow is the amount of future cash flow, minus the projected opportunity cost. This is a very useful cash flow excel template which can be used to calculate the inflow and outflow of cash for a company to calculate its net cash balance. Discounted cash flow (dcf) excel model template aims to help you calculate the value of a business. Even with this version of the discounted cash flow spreadsheet, there are disadvantages to using the dcf model, but it is logical and reasonable.

Source: pinterest.com

Source: pinterest.com

Our discounted cash flow valuation template is designed to assist you through the journey of valuation. Cash flow templates this is our small assortment of professional cash flow spreadsheets. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Guide to discounted cash flow valuation analysis. Before we begin … download the sample dcf model.

Source: pinterest.com

Source: pinterest.com

Increase your productivity with excel templates. Plan future cash flow statements to avoid cash flow. Our discounted cash flow template will help you to determine your value of the investment and calculate how much it will be in the future. Here we discuss the 7 step approach to build a dcf model of alibaba including projections. The discounted cash flow (dcf) formula is equal to the sum of the cash flow valuation free valuation guides to learn the most important concepts at your own pace.

Source: pinterest.com

Source: pinterest.com

Cash flow templates this is our small assortment of professional cash flow spreadsheets. Discounted cash flow (dcf) valuation model is a way to value a company/project based on its future cash flows. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Allows you to start planning with no fuss and maximum of help. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step.

Source: pinterest.com

Source: pinterest.com

The discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. Allows you to start planning with no fuss and maximum of help. Future cash flows are discounted using the cost of equity to determine the present value of money. Download discounted cash flow excel examples in the excel model examples that you’re about to download, you will find taylor devices and liberated syndicated. The discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money.

Source: pinterest.com

Source: pinterest.com

However, if cash flows are different each year, you will have to discount each cash flow separately: Cash flow templates this is our small assortment of professional cash flow spreadsheets. Discounted cash flow (dcf) excel model template aims to help you calculate the value of a business. Our discounted cash flow valuation template is designed to assist you through the journey of valuation. The discount factor is a factor by which future cash flow is multiplied to discount it back to the present value.

Source: pinterest.com

Source: pinterest.com

Enter your name and email in the form below and download the free template now! Basically, a discounted cash flow is the amount of future cash flow, minus the projected opportunity cost. One can calculate the present value of each cash flow while doing calculation manually of the discount factor. Plan future cash flow statements to avoid cash flow. Primitive forms of discounted cash flow analysis have been used since ancient times but have since undergone significant development.

Source: pinterest.com

Source: pinterest.com

Primitive forms of discounted cash flow analysis have been used since ancient times but have since undergone significant development. Increase your productivity with excel templates. Creating a cash flow statement: Discounted cash flow analysis is one of the most important methods to accurately estimate the value of an asset via applying the concept of the time value of money (tvm). One can calculate the present value of each cash flow while doing calculation manually of the discount factor.

Source: pinterest.com

Source: pinterest.com

However, if cash flows are different each year, you will have to discount each cash flow separately: The discounted cash flow valuation model uses a three statement model to derive free cash flows to firm and discounts them to their present value. Enter your name and email in the form below and download the free template now! Feel free to leave a review and a rating if you have appreciated the model!. The discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money.

Source: pinterest.com

Source: pinterest.com

Plan future cash flow statements to avoid cash flow. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Discounted cash flow analysis is one of the most important methods to accurately estimate the value of an asset via applying the concept of the time value of money (tvm). The template comes with various scenarios along with sensitivity analysis. This is also known as the present value (pv) of a future cash flow.

Source: pinterest.com

Source: pinterest.com

However, if cash flows are different each year, you will have to discount each cash flow separately: Allows you to start planning with no fuss and maximum of help. This is also known as the present value (pv) of a future cash flow. Under this method, the expected future cash flows are projected up to the life of the business or asset in question, and the said cash flows are discounted by a. Discounted cash flow (dcf) excel model template aims to help you calculate the value of a business.

Source: pinterest.com

Source: pinterest.com

Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. This is also known as the present value (pv) of a future cash flow. Discounted cash flow (dcf) excel template discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Use the form below to download our sample dcf model: The discount factor effect discount rate with increase in discount factor, compounding of the discount rate builds with time.

Source: pinterest.com

Source: pinterest.com

Cash flow templates this is our small assortment of professional cash flow spreadsheets. Before we begin … download the sample dcf model. Discounted cash flow analysis (dcf) is a method that helps to evaluate your business using the concept of the time value of money. Dcf model (discounted cash flow valuation model) this simple dcf model in excel allows you to value a company via the discounted free cash flow (dcf) valuation method. Download coffee shop financial model template.

Source: pinterest.com

Source: pinterest.com

This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Primitive forms of discounted cash flow analysis have been used since ancient times but have since undergone significant development. The 2 companies are good varying examples because of some differences you’ll notice. In excel, you can calculate this fairly easily using the pv function (see below). The model is completely flexible, so that when you put in the inputs data the model calculates the p&l and does valuation automatically.

Source: pinterest.com

Source: pinterest.com

What is discounted cash flow? Allows you to start planning with no fuss and maximum of help. Future cash flows are discounted using the cost of equity to determine the present value of money. Download discounted cash flow excel examples in the excel model examples that you’re about to download, you will find taylor devices and liberated syndicated. In dcf analysis, essentially what you are doing is projecting the cash flows of a company, project or asset, and determining the value of those future cash flows today.

Source: pinterest.com

Source: pinterest.com

Primitive forms of discounted cash flow analysis have been used since ancient times but have since undergone significant development. The discounted cash flow method is one of the most powerful ways to value a company. Allows you to start planning with no fuss and maximum of help. Cash flow templates this is our small assortment of professional cash flow spreadsheets. Basically, a discounted cash flow is the amount of future cash flow, minus the projected opportunity cost.

Source: in.pinterest.com

Source: in.pinterest.com

Primitive forms of discounted cash flow analysis have been used since ancient times but have since undergone significant development. How to calculate discounted cash flow (dcf) formula & definition. The discounted cash flow method is one of the most powerful ways to value a company. Enter your name and email in the form below and download the free template now! The dcf formula allows you to determine the value of a company today, based on how much money it will likely generate at a future date.

Source: pinterest.com

Source: pinterest.com

How to calculate discounted cash flow (dcf) formula & definition. Discounted cash flow analysis is one of the most important methods to accurately estimate the value of an asset via applying the concept of the time value of money (tvm). Allows you to start planning with no fuss and maximum of help. The discounted cash flow (dcf) is a valuation method that estimates today’s value of the future cash flows taking into account the time value of money. The discounted cash flow valuation model uses a three statement model to derive free cash flows to firm and discounts them to their present value.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title discounted cash flow excel download by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.