38+ Discounted cash flow formula information

Home » Wallpapers » 38+ Discounted cash flow formula informationYour Discounted cash flow formula images are available in this site. Discounted cash flow formula are a topic that is being searched for and liked by netizens now. You can Download the Discounted cash flow formula files here. Download all royalty-free photos.

If you’re searching for discounted cash flow formula images information related to the discounted cash flow formula interest, you have pay a visit to the ideal blog. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

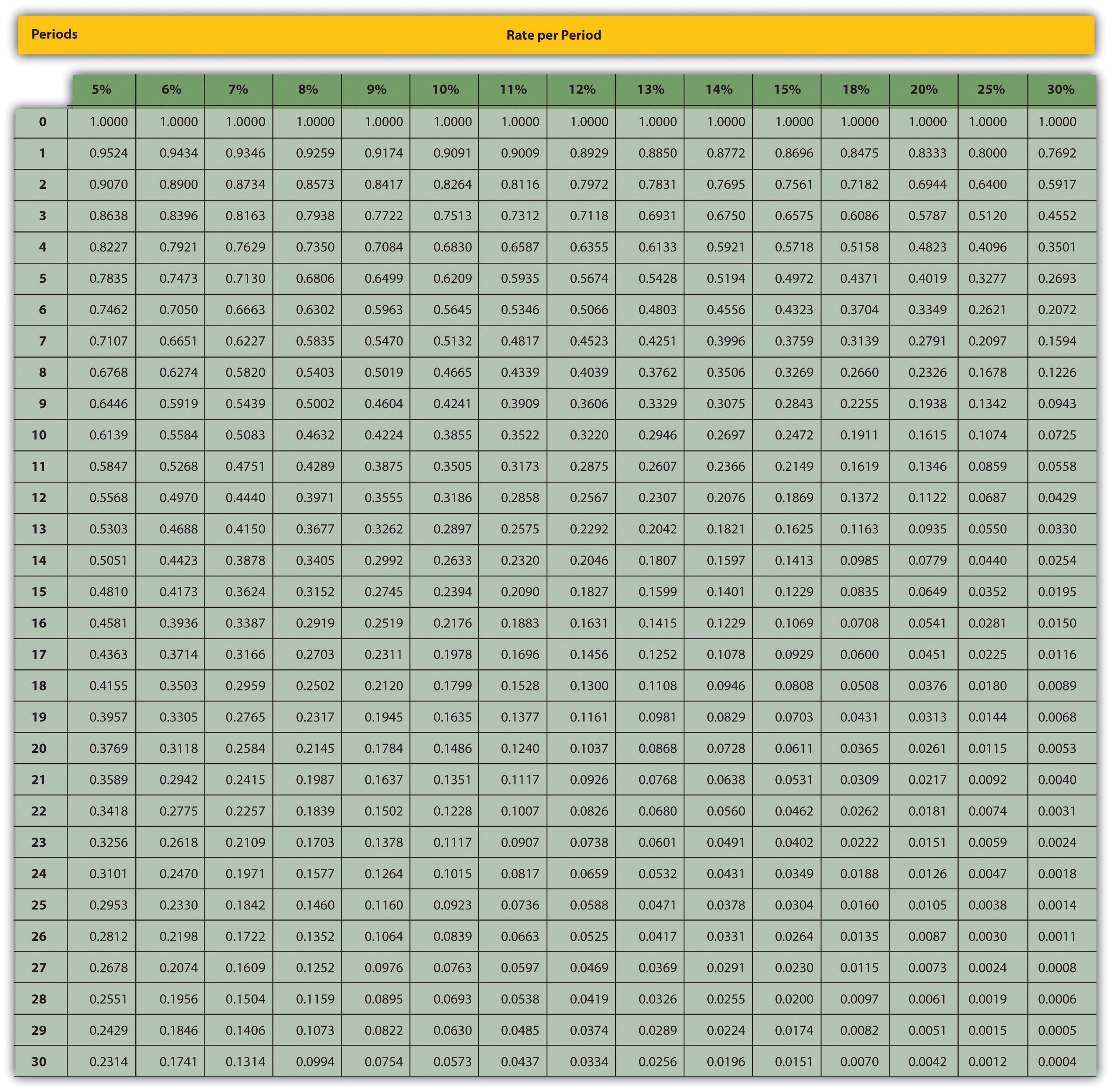

Discounted Cash Flow Formula. Discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. Then the discounted current value of one cash flow in one period in the future is shown with the formula: Sum up the discounted free cash flows we get from year 1 to year 10, we. Discounted cash flow dcf formula the investor must also determine an appropriate discount rate for the dcf model, which will vary depending on the project or investment under consideration.

Developers of Kids’ Apps Need To Find a New Revenue Model From br.pinterest.com

Developers of Kids’ Apps Need To Find a New Revenue Model From br.pinterest.com

Discounted cash flows can be easily calculated by the above formula if there are limited cash flows. Discounted cash flow is a term used to describe what your future cash flow is worth in today�s value. Note that there are several alternatives of the discounted cash flow method: If you assume that it is a firm’s cost of capital after taxes is 6%. Under this method, the expected future cash flows are projected up to the life of the business or asset in question, and the said cash flows are discounted by a. How to calculate discounted cash flow.

The discounted cash flow analysis relies on the information plugged into it, so the end result is dependent on what numbers are used in the formula.

If the investor cannot access the future cash flows, or the project is very complex, dcf will not have much value and alternative models should be employed. All these discounted cash flow methods have in common that (a. = 2.00/ (1+0.10) 1 + 2.10/ (1+0.10) 2 + 2.20/ (1+0.10) 3 +20.00/ (1+0.10) 3. C f = the cash flow for the given year Then the discounted current value of one cash flow in one period in the future is shown with the formula: The idea behind the dcf model is that the value of the company is not a function of demand and supply of the stock.

Source: pinterest.com

Source: pinterest.com

The discounted cash flow (dcf) formula is equal to the sum of the cash flow valuation free valuation guides to learn the most important concepts at your own pace. How to calculate discounted cash flow (dcf) formula & definition. R = the discount rate. It’s also important to note that if you miscalculate your projected cash flows or a part of the discounted cash flow formula, you won’t get an accurate result. = 2.00/ (1+0.10) 1 + 2.10/ (1+0.10) 2 + 2.20/ (1+0.10) 3 +20.00/ (1+0.10) 3.

Source: pinterest.com

Source: pinterest.com

Basically, a discounted cash flow is the amount of future cash flow, minus the projected opportunity cost. These terms might be a little unfamiliar, so here’s a quick guide explaining what they mean: Discounted cash flow is a method of analyzing a company by forecasting its cash flows and discounting the cash flows to arrive at a present value. The discounted cash flow method is regarded as the most justifiable method to appraise the economic value of an enterprise. Cf2 is for year 2.

Source: pinterest.com

Source: pinterest.com

Cf1 is for year 1. Sum up the discounted free cash flows we get from year 1 to year 10, we. Cf2 is for year 2. (1) the forecast period and (2) the terminal value. For bonds, the cash flows are principal and dividend payments.

Source: br.pinterest.com

Source: br.pinterest.com

In finance, discounted cash flow (dcf) analysis is a method of valuing a security, project, company, or asset using the concepts of the time value of money.discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management and patent valuation.it was used in industry as early as the 1700s or 1800s, widely discussed in financial economics. = 2.00/ (1+0.10) 1 + 2.10/ (1+0.10) 2 + 2.20/ (1+0.10) 3 +20.00/ (1+0.10) 3. How to calculate discounted cash flow (dcf) formula & definition. Discounted cash flows can be easily calculated by the above formula if there are limited cash flows. Our online discounted cash flow calculator helps you calculate the discounted present value (a.k.a.

Source: pinterest.com

Source: pinterest.com

d c f = c f 1 1 + r 1 + c f 2 1 + r 2 + c f n 1 + r n where: = 2.00/ (1+0.10) 1 + 2.10/ (1+0.10) 2 + 2.20/ (1+0.10) 3 +20.00/ (1+0.10) 3. Discounted cash flows are most suitable to use for evaluating investment decisions by comparing the discounted cash inflows and cash outflows. How to calculate discounted cash flow. Discounted cash flow for year 1 = 4672.90

Source: in.pinterest.com

Source: in.pinterest.com

5,000 investment is estimated to be 2,800 per year for 2 years. If you assume that it is a firm’s cost of capital after taxes is 6%. The wacc method, the adjusted present value method or the cash to equity method. Discounted cash flow is more appropriate when future condition are variable and there are distinct periods of rapid growth and then slow and steady terminal growth. Under this method, the expected future cash flows are projected up to the life of the business or asset in question, and the said cash flows are discounted by a.

Source: pinterest.com

Source: pinterest.com

The discounted cash flow analysis relies on the information plugged into it, so the end result is dependent on what numbers are used in the formula. Discounted cash flow for year 1 = 4672.90 However, this formula is not convenient to be used in discounting many cash flows. Here is the discounted cash flow formula: Intrinsic value) of future cash flows for a business, stock investment, house purchase, etc.

Source: pinterest.com

Source: pinterest.com

Discounted cash flow dcf formula the investor must also determine an appropriate discount rate for the dcf model, which will vary depending on the project or investment under consideration. Sum up the discounted free cash flows we get from year 1 to year 10, we. The discounted cash flow (dcf) formula is equal to the sum of the cash flow valuation free valuation guides to learn the most important concepts at your own pace. When building a discounted cash flow / dcf model there are two major components: Discounted cash flow for year 1 = 4672.90

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title discounted cash flow formula by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.