48++ Present value of future cash flows info

Home » Background » 48++ Present value of future cash flows infoYour Present value of future cash flows images are ready in this website. Present value of future cash flows are a topic that is being searched for and liked by netizens now. You can Download the Present value of future cash flows files here. Find and Download all free vectors.

If you’re searching for present value of future cash flows pictures information related to the present value of future cash flows keyword, you have pay a visit to the ideal site. Our website always provides you with suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and images that match your interests.

Present Value Of Future Cash Flows. The present value of expected future cash flows is arrived at by using a discount rate to calculate the discounted cash flow (dcf). Present value = $75 ÷ (1 +.10)^2 present value = $75 ÷ (1.10)^2 present value = $75 ÷ 1.21 present value = $61.98. The present value of future cash flows is a method of discounting cash that you expect to receive in the future to the value at the current time. We start with the formula for pv of a future value (fv) single lump sum at time n and interest rate i,

What Is Discounted Cash Flow? in 2020 Cash flow, Value From pinterest.com

What Is Discounted Cash Flow? in 2020 Cash flow, Value From pinterest.com

The time value of money is an important concept to understand, especially when it comes to investing today�s cash into something that will earn cash in the. Present value helps in making decisions on investment, which is based on the current value. This means the money the project is generating in the future is greater than the initial investment of $9,000. According to this figure, the total present value of these future cash flows equals $1,458.59. What is present value (pv)? Future value is that value which will be the value in the future.

Let us take another example of a project having a life of 5 years with the following cash flow.

Present value of $100,000 at 3 percent, end of year 5 = $100,000 x 0.863 = $86,300. Use the sum of the cash inflows to judge the value of the business. As you can see, the future value of cash flows are listed across the top of the diagram and the present value of cash flows are shown in blue bars along the bottom of the diagram. Below is an illustration of what the net present value of a series of cash flows looks like. But, if the loan is cash flowing even with collateral, present value of cash flows must be used to determine the impairment. Npv analysis is a form of intrinsic valuation.

Source: pinterest.com

Source: pinterest.com

Net present value (npv) is the difference between the present value of cash inflows and outflows of an investment over a period of time. 7 to help cpas who use present value and cash flow information as the basis for accounting measurements.using cash flow information and present value in accounting measurements includes general principles governing accountants’ use of present value, particularly when the amount of future cash flows, their timing or both, are uncertain. Present value of $100,000 at 3 percent, end of year 5 = $100,000 x 0.863 = $86,300. What is present value (pv)? Put simply, npv is used to work out how much money an investment will generate compared with the cost adjusted for the time value of money (one dollar today is worth more than one dollar in the future).

Source: pinterest.com

Source: pinterest.com

Present and future value of cash flow. What is present value (pv)? Let us take another example of a project having a life of 5 years with the following cash flow. Use the sum of the cash inflows to judge the value of the business. Determine the present value of all the cash flows if the relevant discount rate is 6%.

Source: pinterest.com

Source: pinterest.com

Present value is the sum of money of future cash flows today whereas future value is the value of future cash flows at a specific date. But, if the loan is cash flowing even with collateral, present value of cash flows must be used to determine the impairment. Now suppose that we wanted to find the future value of these cash flows instead of the present value. Reset the interest rate to 12% and b9 to 500 before continuing. Present value (pv) is the current value of a future sum of money or stream of cash flows given a specified rate of return.future cash flows are discounted at the.

Source: pinterest.com

Source: pinterest.com

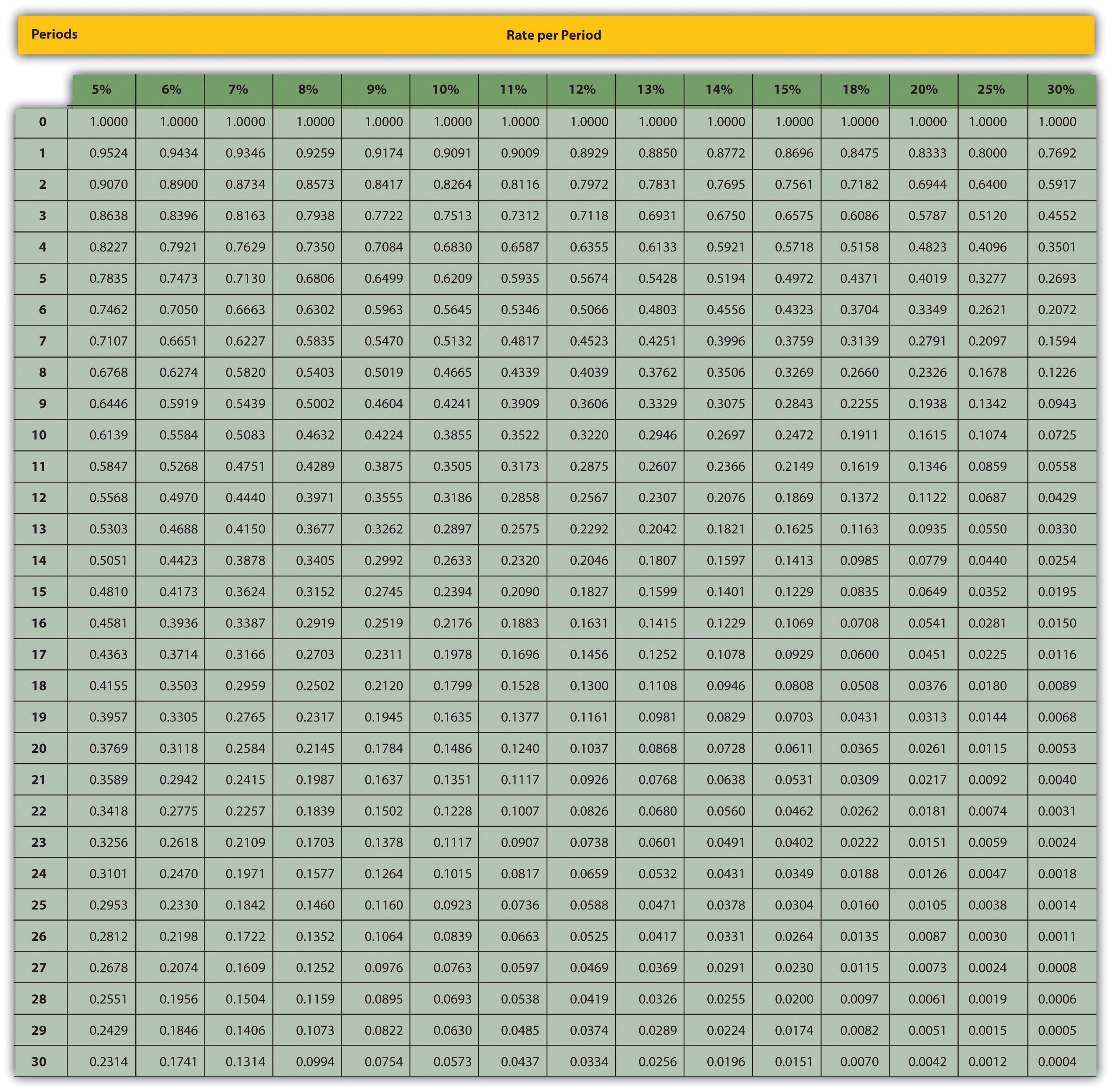

Present value (pv) is the current value of a future sum of money or stream of cash flows given a specified rate of return.future cash flows are discounted at the. Present value and future value tables visit knowledgequity.com.au for practice questions, videos, case studies and support for your cpa studies The pv of future cash flows is $399; Use the sum of the cash inflows to judge the value of the business. 7 to help cpas who use present value and cash flow information as the basis for accounting measurements.using cash flow information and present value in accounting measurements includes general principles governing accountants’ use of present value, particularly when the amount of future cash flows, their timing or both, are uncertain.

Source: pinterest.com

Source: pinterest.com

This means the money the project is generating in the future is greater than the initial investment of $9,000. The year two cash flow would be discounted similarly: Example 3.1 — future value of uneven cash flows. The present value of the projected cash flows is $13,266.84. When to use present value of future cash flows once a loan has been deemed impaired, the method selected to determine the impairment should default to the present value of cash flows unless there is collateral that will pay 100 percent of amounts due to the bank.

Source: in.pinterest.com

Source: in.pinterest.com

Present value is calculated by taking inflation into consideration whereas a future value is a nominal value and it adjusts only interest rate to calculate the future profit of the investment. What is net present value (npv)? Further, according to the fasb statement of financial accounting standards no. The time value of money is an important concept to understand, especially when it comes to investing today�s cash into something that will earn cash in the. Present value and future value tables visit knowledgequity.com.au for practice questions, videos, case studies and support for your cpa studies

Source: pinterest.com

Source: pinterest.com

Example 3.1 — future value of uneven cash flows. What is net present value (npv)? Npv analysis is a form of intrinsic valuation. Present value (pv) is the current value of a future sum of money or stream of cash flows given a specified rate of return.future cash flows are discounted at the. Net present value (npv) is the difference between the present value of cash inflows and outflows of an investment over a period of time.

Source: pinterest.com

Source: pinterest.com

Example 3.1 — future value of uneven cash flows. The present value of future cash flows is a method of discounting cash that you expect to receive in the future to the value at the current time. Below is an illustration of what the net present value of a series of cash flows looks like. Any liquidation proceeds net of selling costs would be used to supplement cash flow. What is present value (pv)?

Source: pinterest.com

Source: pinterest.com

According to this figure, the total present value of these future cash flows equals $1,458.59. The present value of the projected cash flows is $13,266.84. What is net present value (npv)? Present value is calculated by taking inflation into consideration whereas a future value is a nominal value and it adjusts only interest rate to calculate the future profit of the investment. Present value and future value tables visit knowledgequity.com.au for practice questions, videos, case studies and support for your cpa studies

Source: pinterest.com

Source: pinterest.com

An institution may wish to rely on the fair value of collateral method for its convenience, even if the borrower continues to pay. Present value is the sum of money of future cash flows today whereas future value is the value of future cash flows at a specific date. Npv analysis is a form of intrinsic valuation. An institution may wish to rely on the fair value of collateral method for its convenience, even if the borrower continues to pay. Below is an illustration of what the net present value of a series of cash flows looks like.

Source: pinterest.com

Source: pinterest.com

Reset the interest rate to 12% and b9 to 500 before continuing. Present value (pv) is the current value of a future sum of money or stream of cash flows given a specified rate of return.future cash flows are discounted at the. Present value is the sum of money of future cash flows today whereas future value is the value of future cash flows at a specific date. The present value of the projected cash flows is $13,266.84. Now suppose that we wanted to find the future value of these cash flows instead of the present value.

Source: pinterest.com

Source: pinterest.com

What is net present value (npv)? We start with the formula for pv of a future value (fv) single lump sum at time n and interest rate i, Present value helps in making decisions on investment, which is based on the current value. Let us take another example of a project having a life of 5 years with the following cash flow. What is present value (pv)?

Source: pinterest.com

Source: pinterest.com

Information about the risks of any investment is used to derive a discount rate appropriate for estimating the present value of future cash flows , which is the basis of most asset pricing models. According to this figure, the total present value of these future cash flows equals $1,458.59. 7 to help cpas who use present value and cash flow information as the basis for accounting measurements.using cash flow information and present value in accounting measurements includes general principles governing accountants’ use of present value, particularly when the amount of future cash flows, their timing or both, are uncertain. So here rs 110 is the future value of rs 100 at 10%. Net present value, or npv, expresses the value of a series of future cash flows in today’s dollars.

Source: pinterest.com

Source: pinterest.com

This means the money the project is generating in the future is greater than the initial investment of $9,000. Determine the present value of all the cash flows if the relevant discount rate is 6%. Therefore, the present value of the sum can be calculated as, pv = c / (1 + r) n = $1,000 / (1 + 5%) 4. Any liquidation proceeds net of selling costs would be used to supplement cash flow. Present and future value of cash flow.

Source: pinterest.com

Source: pinterest.com

The present value of the projected cash flows is $13,266.84. Further, according to the fasb statement of financial accounting standards no. Executive summary fasb issued concepts statement no. How to evaluate the npv of a capital project to evaluate the npv of a capital project, simply estimate the expected net present value of the future cash flows from the project, including the project’s initial investment as a negative amount. If you find a present value factor for all payments, you can compute the present value of all cash inflows.

Source: pinterest.com

Source: pinterest.com

How to evaluate the npv of a capital project to evaluate the npv of a capital project, simply estimate the expected net present value of the future cash flows from the project, including the project’s initial investment as a negative amount. Present value of cash flow formulas. Reset the interest rate to 12% and b9 to 500 before continuing. What is present value (pv)? The present value, pv, of a series of cash flows is the present value, at time 0, of the sum of the present values of all cash flows, cf.

Source: pinterest.com

Source: pinterest.com

Present and future value of cash flow. Net present value (npv) is the difference between the present value of cash inflows and outflows of an investment over a period of time. Therefore, the project has the potential to give you a positive return on investment. Below is an illustration of what the net present value of a series of cash flows looks like. Npv analysis is a form of intrinsic valuation.

Source: pinterest.com

Source: pinterest.com

Any liquidation proceeds net of selling costs would be used to supplement cash flow. Put simply, npv is used to work out how much money an investment will generate compared with the cost adjusted for the time value of money (one dollar today is worth more than one dollar in the future). Therefore, the project has the potential to give you a positive return on investment. But, if the loan is cash flowing even with collateral, present value of cash flows must be used to determine the impairment. Present value helps in making decisions on investment, which is based on the current value.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title present value of future cash flows by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.